OLS#

R-Square:#

- The coefficient of determination (R-squared or R2) provides a measure of the goodness of fit for the estimated regression equation

- R2 = SSR/SST = 1 – SSE/SST

- Values of R2 close to 1 indicate perfect fit, values close to zero indicate poor fit.

- R2 that is greater than 0.25 is considered good in the economics field.

- R-squared interpretation: if R-squared=0.8 then 80% of the variation is explained by the regression and the rest is due to error. So, we have a good fit.

Adjusted $R^2$#

R2 always increases when a new independent variable is added. This is because the SST is still the same but the SSE declines and SSR increases. Adjusted R-squared corrects for the number of independent variables and is preferred to R-squared.

$$ R^2_a = 1 - (1- R^2)\frac{n-1}{n-p-1} $$where p is the number of independent variables, and n is the number of observations.

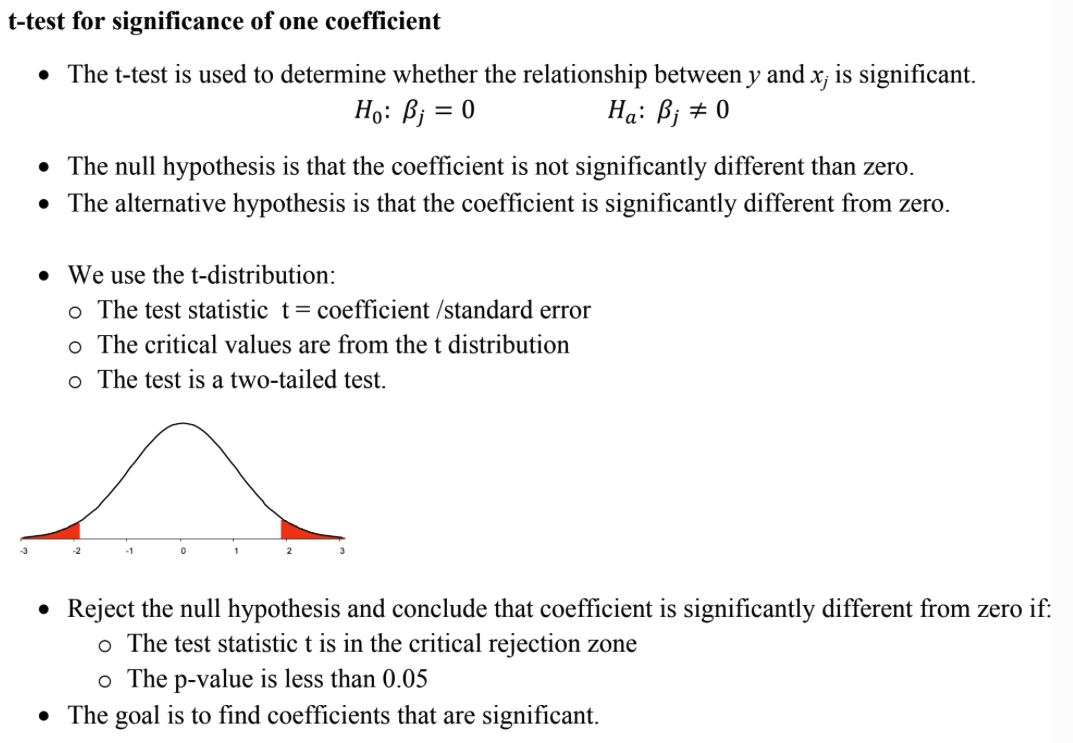

T-test for one coef:#

F-test for all coef:#

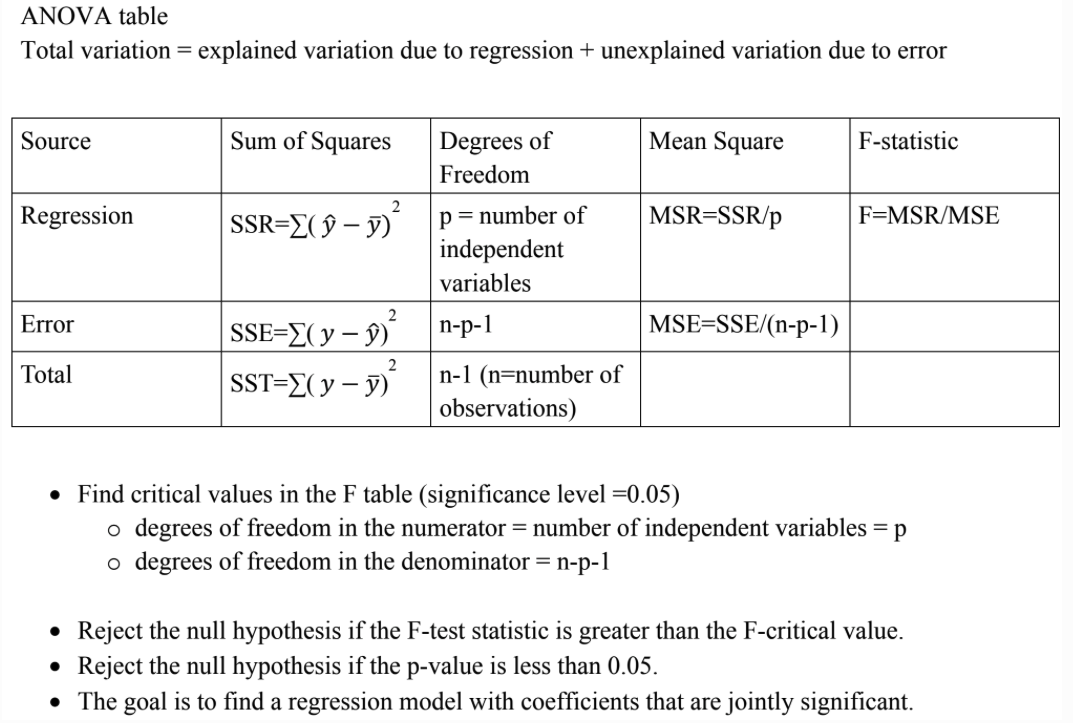

ANOVA Table#

Linear Regression Assumptions:#

Gauss Markov Assumptions are standard assumption for the LR model. If all assumptions satisfied, then OLS estimator is the best linear unbiased estimator of the coefficient,

Linearity in parameter $\beta$ (however, x can be anything, i.e $x^2, log(x)$)

Random Sampling. The data are a random sample drawn from the population

No perfect collinearity(Can be detected by plotting correlation heat map, OR VIF, drop variable if $VIF_j >10$)

- $$VIF_j = \frac{1}{1-R_j^2}$$

Zero conditional mean(exogeneity) - regressors are not corrected with the error term. Endogeneity is a violation of the assumption where independent variable are correlated with the error term, can be handle with Instrumental Variables

[!Note]

The first four assumptions ensures that OLS estimater is unbiased, i.e.

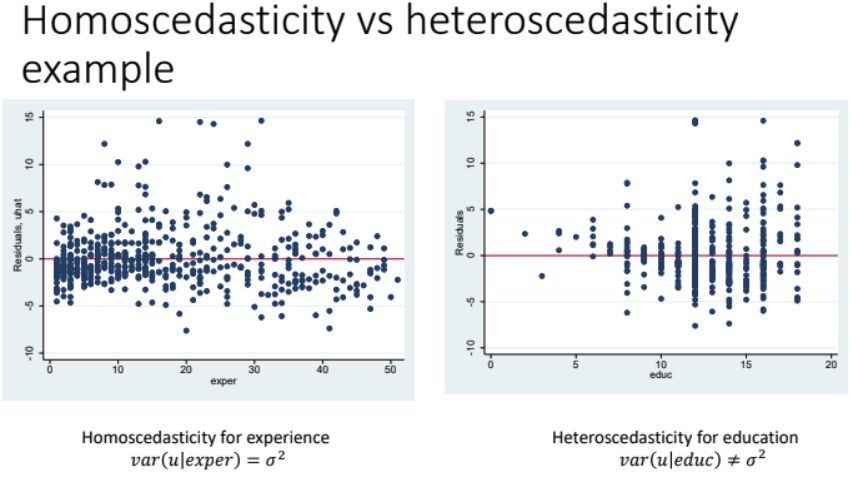

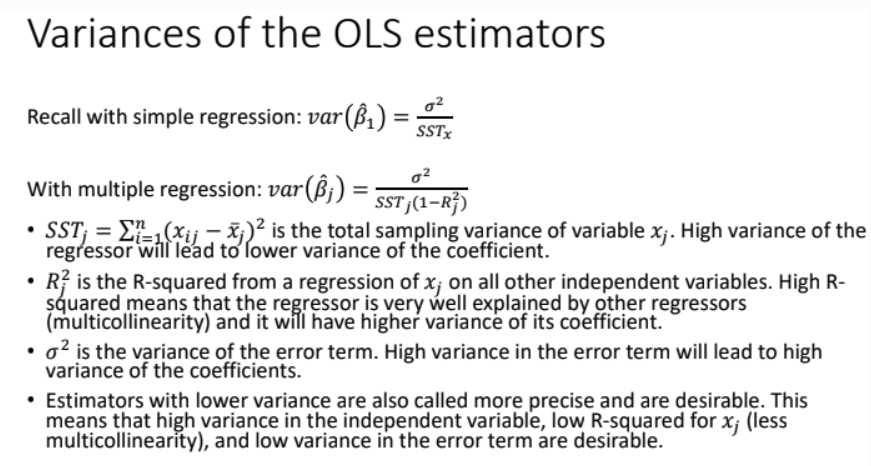

$$ > E(\hat \beta_j) = \beta_j > $$Homoscedasticity: The variance of the error term u does not differ with the independent variable (we can check by plotting the residuals)

- Consequence of Heteroscedasticity: The variance formula of OLS is no longer valid, t-test and F-test not valid, OLS is not BLUE.

- To handle Heteroscedasticity, we can use Weighted Least Squares. If the Heteroscedasticity form is not known, the Feasible Generalized Least Square transforms the variable to get homoscedasticity.

- LM-Test: $nR^2 \sim \chi_k^2$ , p>0.05 homo, otherwise hetero

How to Compute OLS in R?#

$$ \hat \beta = (X^TX)^{-1}X^Ty $$x <- c(1, 2, 3, 4, 5)

y <- c(2, 3, 5, 7, 11)

X <- cbind(1, x)

XtX <- t(X) %*% X

XtY <- t(X) %*% y

beta_hat <- solve(XtX) %*% XtY

y_hat <- X %*% beta_hat

residuals <- y - y_hat

SSE <- sum(residuals^2)

SST <- sum((y - mean(y))^2)

# R²

R_squared <- 1 - SSE / SST

Time Series#

AR Model#

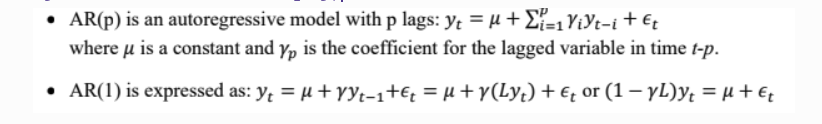

Autoregressive (AR) models are models in which the value of a variable in one period is related to its values in previous periods.

MA Model#

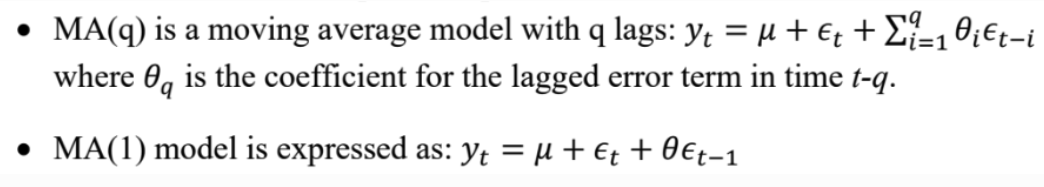

Moving average (MA) models account for the possibility of a relationship between a variable and the residuals from previous periods.

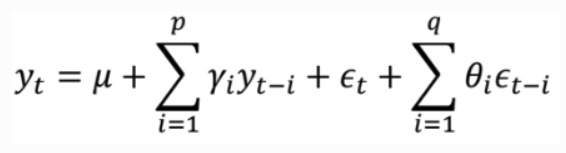

ARMA Model#

Autoregressive moving average (ARMA) models combine both p autoregressive terms and q moving average terms, also called ARMA(p,q).

Stationarity#

- Modeling ARMA(p, q) requires stationarity (an upward and downward trend means it is not stationary, need to differentiate at lag 1, e.g. $ARIMA(p, 1, q)$, making the first difference stationary process.

- Dick-Fuller Test for stationarity -> p>0.05 Non-Stationary

Seasonality#

Seasonality is is a particular type of autocorrelation pattern where patterns occur every “season,” if there is a seasonal trend at lag 7, we should choose a $SARIMA(p, 1, q), (P, 1, Q)_7$ model

Box-Cox Transform#

Use Box-Cox Transformation to stablize variance, this can handle the heteroskedasticity issue in our data, which improve the accuracy. The Box Cox use MLE to estimate the best lambda. If $\lambda = 1$ , no transformation needed. If $\lambda \rightarrow 0$, consider log transformation.

ACF and PACF#

ACF is the proportion of the autocovariance of $y_t$ and $y_{t-k}$ to the variance of a dependent variable $y_t$. PACF is the correlation between $y_t$ and $y_{t-k}$ minus the part explain by the intervening lags.

- For an AR(p) model, the PACF is γ for the p lag and then cuts off.

- For an MA(q) model, the ACF is $\theta$ for the q lag and then cuts off.

- For an ARMA(p, q) model, both ACF and PACF changes gradually (no sudden decay to 0)

- For non-stationary model, ACF shows a slow decaying positive ACF, choose ARIMA(p, 1, q)

- For data with seasonarity, ACF show spike every s lag, choose $SARIMA(p, 1, q), (P, 1, Q)_s$

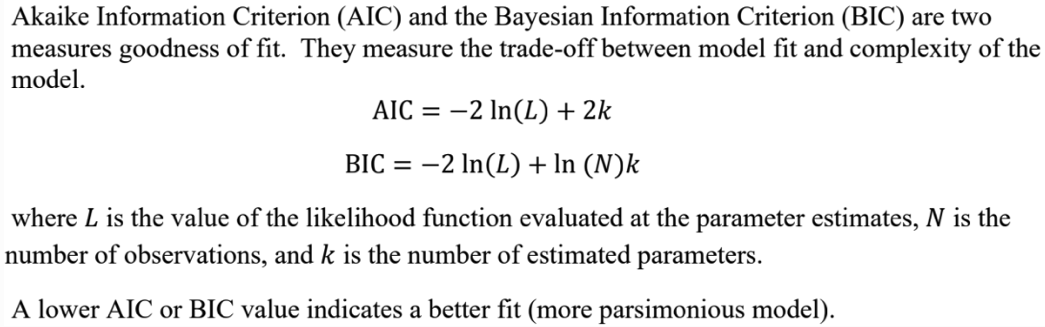

Model Selection with AIC and BIC#

Diagnostic#

- Check QQ plot for normality of the residual

- ACF and PACF show look like white noise

- Ljung Box Pierce test for magnitude of the autocorrelation of correlation as a group

- Check the roots of the AR and MA polynomials — either numerically or by plotting them on the unit circle. If they are both outside the unit circle, then it indicates stationarity(AR) and invertibility(MA)

Panel Data Models#

Multiple time and mulitple variable:

- Varying regressors(annual income for a person, monthly food expenditures)

- Time-invariant regressors (gender, race, education)

- Individual-invariant regressor (time trend, US unemployment rate)

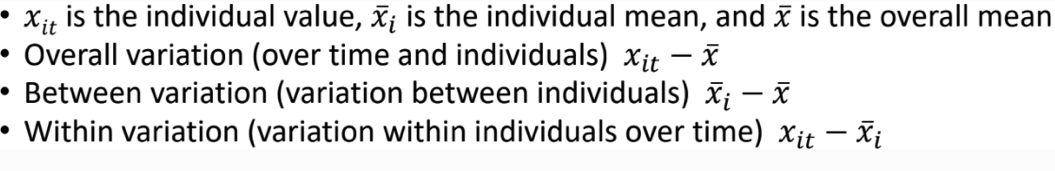

Variation:

Pool OLS Estimator#

Use when is homogeneous across individuals(rare in practice)

$$ y_{it} = \beta x_{it}+ u_{it} $$$N*T$ observations

Between Estimator#

Uses cross sectional variation only: use when we interest in explaining the difference between two units (e.g. why one region uses more energy than another on average)

Drawback: Loses time series variation and cannot control for unobserved hetergeneity within units.

$$ \bar y_{i} = \beta \bar x_{i}+ \bar u_{i} $$First Difference Estimator (FD)#

Removes individual fixed effects by differencing data across time, use when the error term includes an individual-specific fixed effect, and serial correlation is not a concern.

$$ \Delta y_{it} = \beta \Delta x_{it}+ \Delta u_{it} $$Fixed Effects Estimator#

Use when we believe unit-specific effects (e.g., regions, firms) are correlated with the regressors — for example, unobserved factors like income levels, regulation, or infrastructure that also affect energy usage, but it cannot estimate coefficients on time-invariant variables (e.g., population size if constant for each region).

$$ y_{it} - \bar y_{i} = \beta ( x_{it} - \bar x_i) + (u_{it} -\bar u_{i}) $$Random Effects Estimator#

Use when we believe those unit effects are uncorrelated with the regressors — which is a strong assumption. Assume: No correlation between unit effects and independent variables. Uses GLS (Generalized Least Squares); more efficient than FE if assumption holds.

$$ y_{it} = a + \beta x_{it} + u_{i} + \epsilon_{it} $$Hausman Test#

The Hausman test is used to decide whether to use the fixed effects (FE) or random effects (RE) estimator.